- All

- Alternative Investment Funds

- Corporate Laws

- Corporate Social Responsibility

- Digital Assets

- Finance & Taxation

- GeM Registration

- POSH

- Shares & Stocks

Guide to Income Tax Slabs and Benefits for Senior Citizens FY 2024-25

ashmeet singh

ashmeet singh

February 23, 2024

February 23, 2024

Guide to Income Tax Slabs and Benefits for Senior Citizens FY 2024-25 Are you a senior citizen navigating income tax...

Read More

Facing an outstanding Goods and Services Tax (GST) demand on the GST portal

ashmeet singh

ashmeet singh

February 14, 2024

February 14, 2024

Facing an outstanding Goods and Services Tax (GST) demand on the GST portal Facing an outstanding Goods and Services Tax...

Read More

GUIDELINES FOR FILING / REVISING FORM TRAN-1 & TRAN-2

Shivani Gupta

Shivani Gupta

October 4, 2022

October 4, 2022

GUIDELINES FOR FILING/REVISING FORM TRAN-1 & TRAN-2 The Hon’ble Supreme Court of India has provided a one-time opportunity to all...

Read More

TDS Implications on NGOs’

ashmeet singh

ashmeet singh

May 17, 2022

May 17, 2022

TDS IMPLICATIONS ON NGOs’ CA Vikram Singh Rawat | updated: 17 May, 2022 Applicability of TDS on NGOs’ Payment TDS...

Read More

Vendor Assessment On Government e-Marketplace(GeM)

ashmeet singh

ashmeet singh

May 16, 2022

May 16, 2022

Vendor Assessment On GeM (Government e-Marketplace) CS Shivani Gupta | Updated: 16 May, 2022 Whar is Vendor Assessment Vendor Assessment...

Read More

Penalties Under Income Tax Act

ashmeet singh

ashmeet singh

May 6, 2022

May 6, 2022

PENALTIES UNDER INCOME TAX ACT, 1961 Kopal Jain | Updated: 6 May, 2022If an assessee commits an offence under Income...

Read More

Section 6 of the Income Tax Act

ashmeet singh

ashmeet singh

May 6, 2022

May 6, 2022

Section 6 of Income Tax Act, 1961 Vikram Singh Rawat | Updated: 5 May, 2022Section 6 of Income Tax Act,...

Read More

Conversion of Loan into Equity

ashmeet singh

ashmeet singh

May 3, 2022

May 3, 2022

CONVERSION OF LOAN INTO EQUITY CS Priyanka Chuphal | Updated: 2 May, 2022Conversion of loan into Equity Share Capital is...

Read More

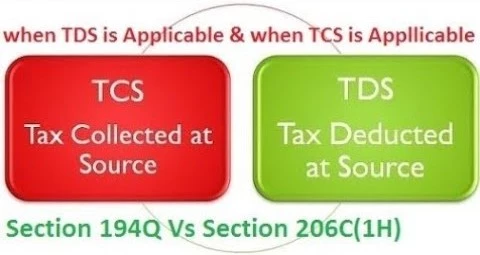

Section 194Q vs Section 206C (IH)

ashmeet singh

ashmeet singh

May 3, 2022

May 3, 2022

Difference Between Section 194Q and 206 C (1H) of the Income Tax Act, 1961 Mansi Bhatt | Updated: 15 April,...

Read More

TDS vs TCS – A Brief Comparison

ashmeet singh

ashmeet singh

May 3, 2022

May 3, 2022

TDS v/s TCS - A brief comparison Mansi Bhatt | Updated: 2 April, 2022 The Finance Act, 2020 had introduced...

Read More

FAQs related to Section 10(23C) of the Income Tax Act, 1961

ashmeet singh

ashmeet singh

May 2, 2022

May 2, 2022

FAQs related to Section 10(23C) of the Income Tax Act, 1961 Kopal Jain | Updated: 1 May, 2022Section 10(23C) of...

Read More

Section 269T of the Income Tax Act

ashmeet singh

ashmeet singh

April 7, 2022

April 7, 2022

Section 269T of the Income Tax Act 1961 Mansi Bhatt | Updated: 2 April, 2022Sections 269T of the Income Tax...

Read More

Right Issue vs Private Placement vs Preferential Allotment

ashmeet singh

ashmeet singh

April 7, 2022

April 7, 2022

Right Issue vs. Private Placement vs. Preferential Allotment Under Companies Act, 2013 CS Shivani Gupta | Updated : 01st April...

Read More

Brief Compliance Guide On POSH Laws

ashmeet singh

ashmeet singh

March 21, 2022

March 21, 2022

Brief Compliance Guide On POSH Laws CS Priyanka Chuphal | Updated: 21 March, 2022 In an attempt to enable a...

Read More

Virtual Digital Asset & Tax Implication On Its Income

ashmeet singh

ashmeet singh

March 17, 2022

March 17, 2022

Virtual Digital Asset & Tax Implication on its Income CA Vikram Singh Rawat | Updated; 17 March, 2022 MEANING OF...

Read More

Accounting Treatment Of Corporate Social Responsibility

ashmeet singh

ashmeet singh

March 2, 2022

March 2, 2022

Accounting Treatment Of Corporate Social Responsibility Kopal Jain | Updated: 28 February, 2022 “Creating a strong business and building a...

Read More

Annual Information Statement

ashmeet singh

ashmeet singh

March 2, 2022

March 2, 2022

ANNUAL INFORMATION STATEMENT Lokesh Kumar | Updated: 28 February, 2022 Annual Information statement (AIS) is a comprehensive statement of information...

Read More

Section 269SS of the Income Tax Act

ashmeet singh

ashmeet singh

March 2, 2022

March 2, 2022

Section 269SS of the Income Tax 1961 Mansi Bhatt | Updated: 28 February, 2022 Section 269SS of the Income Tax...

Read More

Security Analysis of Stocks

ashmeet singh

ashmeet singh

March 2, 2022

March 2, 2022

Security Analysis Of Stocks Om Prakash Jha | Updated: 28 February, 2022 Security Analysis of stocks means, analyzing the risk-return...

Read More

Consequences of Non-Compliance Under Companies Act, 2013

jyoti thukral

jyoti thukral

November 8, 2021

November 8, 2021

Consequences For Non-Compliance Under The Companies Act. 2013 CS Priyanka Chuphal | Updated: 15 October, 2021 Companies have a normal...

Read More

Compliance And Policies of AIF

jyoti thukral

jyoti thukral

November 8, 2021

November 8, 2021

FEMA & Other Regulatory Compliance for AIFs CS Shivani Gupta | Updated: 22 November, 2021 S.NoParticularsFrequencySubmission Date1.The AIF, which has...

Read More

Can a Company Give Loan to its Directors?

jyoti thukral

jyoti thukral

November 8, 2021

November 8, 2021

Can a Company give Loans to its Directors ??? CS Priyanka Chuphal | Updated: 20 October, 2021 Section 185 of...

Read More

Corporate Social Responsibility

jyoti thukral

jyoti thukral

November 8, 2021

November 8, 2021

Corporate Social Responsibilty Kopal Jain | Updated: 28 December, 2021The Corporate Social Responsibility concept in India is governed by Section...

Read More

.gif)