ANNUAL INFORMATION STATEMENT

Lokesh Kumar | Updated: 28 February, 2022

Annual Information statement (AIS) is a comprehensive statement of information related to income received and material transaction made during the financial year, rolled out by the Income Tax Department in November 2021. It also provides the option of taking taxpayer feedback for information provided in AIS Information in Annual Information Statement is compiled from the data reported by the various reporting entity such as RTO, registration offices, listed entities, RBI

OBJECTIVE OF INTRODUCING AIS

The objective of AIS is to facilitate the taxpayer in filling tax return more accurately, leaving zero chance for non-reporting of any income. Such statement is also used in preparing prefill income tax returns.

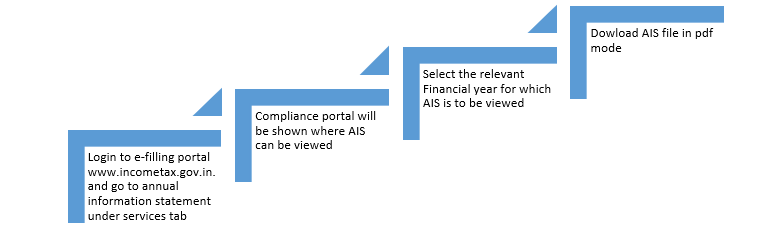

HOW TO ACCESS OR DOWNLOAD ANNUAL INFORMATION STATEMENT

*downloaded file will be password protected file and the password is the combination of taxpayer PAN (Upper case) and date of birth in case of individual taxpayer and date of incorporation or formation in other cases

INFORMATION PROVIDED IN AIS

| Part A | Part B |

This part covers basic information pertaining to taxpayer :

| This section covers the following:

|

FEEDBACK OF TAXPAYER FOR INFORMATION IN AIS

Taxpayers can submit his/her feedback in case she/he is not satisfied with information contained in AIS through compliance portal, such option is available at same place from user downloads AIS(as discussed above).

.gif)