Vendor Assessment On GeM (Government e-Marketplace)

CS Shivani Gupta | Updated: 16 May, 2022

Whar is Vendor Assessment

Vendor Assessment is one aspect of Vendor validation on the GeM portal. It is done to determine the quality of a vendor and its products & services. The assessment will be put into GeM ratings, and the product/service will then be designated verified, which is a filterable parameter that the buyer may utilize in their selection process. This will help buyers make better decisions.

From 1 August 2017, all the manufacturers and resellers are required to claim their OEM to be able to offer their goods and services on GeM.

Currently, the Quality Council of India (QCI) is in charge of conducting vendor assessments of all vendors on GeM.

Some important key points of Vendor Assessment are:

From 1 August 2017, all the manufacturers and resellers are required to claim their OEM to be able to offer their goods and services on GeM.

Currently, the Quality Council of India (QCI) is in charge of conducting vendor assessments of all vendors on GeM.

Some important key points of Vendor Assessment are:

- The validity of a vendor assessment is 3 years. However, a vendor can opt for vendor assessment even before the expiry of validity.

- The Government fee for Vendor Assessment on the GeM portal is ₹11,200 (Excluding GST).

- All those entities that possess Certificate are exempted from Vendor Assessment on GeM.

Who can apply for Vendor Assessment ?

Vendor Assessment is mandatory for sellers who want to participate in the public procurement of Q1 and Q2 category products on GeM.

Original Equipment Manufacturers (OEM) can apply for Vendor Assessment if they are:

If the products are manufactured outside India, and that location does not share a land border with India, then the manufacturing entity should become a Deemed OEM on GeM.

Original Equipment Manufacturers (OEM) can apply for Vendor Assessment if they are:

- Manufacturing Unit

- Assembling Unit

- Third-Party manufacturer with or without Brand Name

If the products are manufactured outside India, and that location does not share a land border with India, then the manufacturing entity should become a Deemed OEM on GeM.

Documents required for Vendor Assessment

Documents that are required for Vendor Assessment include but are not limited to :

- Company/ Firm registration documents

- Name, Contact details with the e-mail address of the promoters

- PAN card copy

- Memorandum of Association & Articles of Association (in case of Companies) or Partnership Deed (in case of Partnership firm)

- GST registration (all required in case of multiple billing addresses)

- Cancelled Bank Cheque

- Copy of Purchased Order copies, Delivery Challans, GRN (Goods Received Note), Invoice for Government Tenders/ Businesses for the last three financial years. These documents are required for all the order details filled in the form of government orders and corporate

- Financial Statements (Profit & Loss Statement and Balance Sheet) for the last three financial

- Vendor Principal Agreement copy (applicable if the entity is a dealer or a vendor of an OEM)

- Banker Reference Letter on account performance

- Management undertaking stating that the firm is not debarred/blacklisted by any Government

- Management undertaking for years of experience in dealing with Government

Assessment Methodology

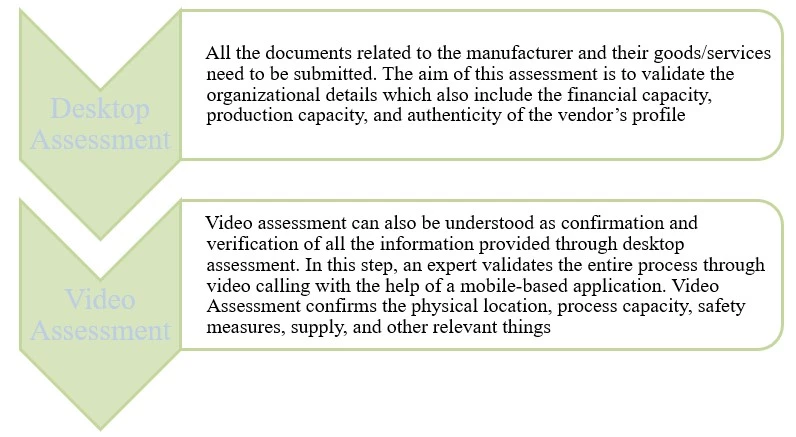

The Vendor Assessment for OEMs is based on three broad parameters i.e., physical location (vendor profile), financial capacity and production capability. The assessment will be carried out in the following stages:

Vendor Assessment Exemption

An inclusive list of exempted sellers is provided as below.

- Sellers having annual turnover of 500 Crore or more, at least in one of the latest three years as captured during registration.

- Central / State

- All sellers who are validated through PAN or GSTN or MCA-21 and offering products only for direct selling up to the value of 25,000 per unit and whose yearly turnover is not more than Rs.5,00,000. Sellers who are offering products as OEM shall not be covered under this exemption.

- Sellers offering products like Artwork, handicrafts, and other such items where no standard manufacturing process The exempted categories shall be specified by the category owner.

- Sellers who are Registered Societies/ Trusts or any other bodies with Government

- KVIC, WDO, Coir Board,

- OEMs who are registered with NSIC(for the category for which registration was obtained). This exemption will be coterminous with NSIC certificate validity.

- OEMs holding BIS License for the particular product category which are validated through BIS database. Normal validity for this exemption will be three years. Seller is mandated to notify GeM in case cancellation of BIS license and exemption will be

- OEMs having Unique Certification Code (UCC) issued by DRDO/ OFB/ This exemption will be coterminous with UCC certificate validity.

- Sellers recommended for exemption for specific categories and specified validity period by any CPSE, Central and State Government Departments/

- Any other category of sellers as notified with the approval of CEO-GeM.

.gif)