CONVERSION OF LOAN INTO EQUITY

CS Priyanka Chuphal | Updated: 2 May, 2022

Conversion of loan into Equity Share Capital is the most reliable mode to reduce liabilities of the Company and convert them into Shares. In order to carry out the business smoothly, at times, debt is converted into share capital.

As per provisions of Section 62(3) of the Companies Act, 2013 (“the Act”) in order to convert a loan into share capital, the company has to raise the loan on the terms that the loan will be converted into share capital and such option has been approved by special resolution before sanction of such loan and only in such case, the subscribed and paid-up capital can be increased.

CONDITIONS FOR CONVERSION OF LOAN INTO EQUITY

- Terms of Conversion to be attached to sanction letter of Loan.

- Approval of shareholders by passing Special Resolution in general meeting obtained at the time of issue of debenture or loan.

- Filling of E-form MGT-14 within 30 days of passing the Special Resolution.

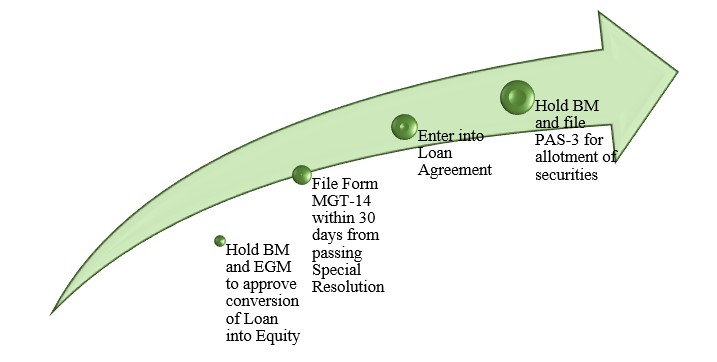

PROCESS FOR CONVERSION OF LOAN INTO EQUITY

Stage I: Steps Before Acceptance Of Loan

STEP-I- Holding of Board Meeting:

- To pass a resolution for Acceptance of Loan.

- To pass board resolution for conversion of such loan into Equity Share Capital of the company.

- To issue notice for holding of Extra Ordinary General Meeting of shareholders.

STEP-II- Holding of Extra Ordinary General Meeting:

- Company shall pass Special Resolution for conversion of such Loan into Equity Share capital of the company in future.

- File E-form MGT 14 within 30 days of passing the Special Resolution with concerned ROC.

STEP-III- Enter into Agreement:

- Company shall enter into a Loan Agreement.

- Such agreement should contain the term of conversion of such loan or debenture into Equity share capital of company in future.

Stage-II- Steps At The Time Of Conversion Of Loan Into Share Capital:

STEP-IV-Holding of Board Meeting:

- Pass Board Resolution for Allotment of Equity Shares against amount of loan to be converted.

- Preparation of list of allottees.

- Filling of e-form PAS-3 for allotment of shares within 30 days of passing of Board Resolution for allotment.

COMMON QUERIES

If a Company has accepted loan before 1st April 2014 (i.e. under Companies act 1956) and wants to convert such loan into equity shares at present. Whether it is allowed?

- As per the provision under Companies Act, 1956 there was no requirement to pass prior Special resolution for conversion.

- However, as per provision of Companies Act, 2013 it is mandatory that the company had passed special resolution at the time of acceptance of loan.

Therefore, if a company wants to convert the loan accepted in Companies Act, 1956 and no Special resolution passed at that time for conversion of such loan in future then company can’t convert such loan due to the requirements of Section 62(3) of the Act.

OPINION ON QUERY:

An alternative route to convert loan into equity capital is by opting for preferential allotment route specified in the provisions under Section 62(1)(c) of the Act by allotting share capital for consideration other than cash and following the procedure specified under Section 42 of the Act and Rule 13 of the Companies (Share Capital and Debentures) Rules, 2014. Whereas, this route can be opted in case the terms of the loan containing option to convert debt into equity have not been approved prior to sanction of loan but this route is time and cost intensive as compared to the route provided under section 62(3) of the Act due to requirement of multiple filings and valuation report from a registered valuer.

.gif)